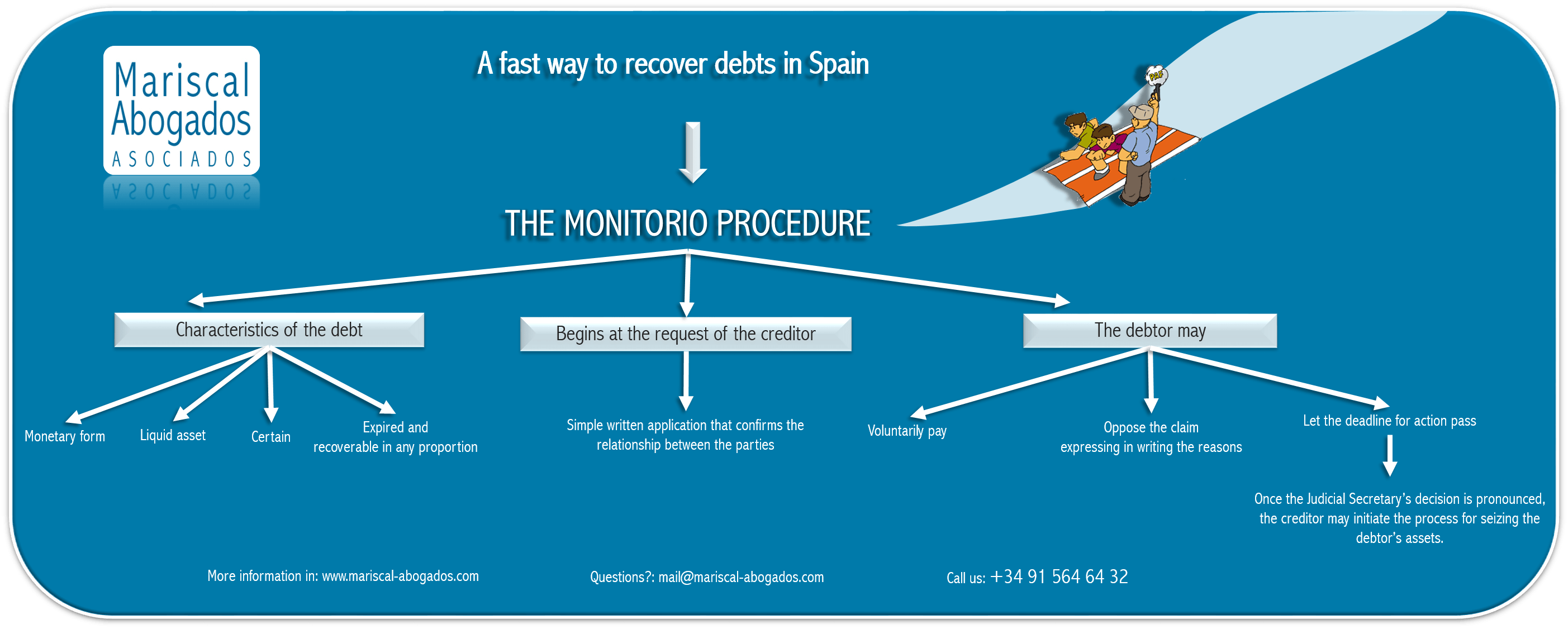

The monitorio procedure is one of the instruments introduced with the passing of the Civil Proceedings Law in Spain (CPL) to strengthen the protection of credit. Articles 812 to 818 of the aforementioned legal document regulate this procedure. It is a quick and easy way to reclaim monetary debts.

Monitorio is currently one of the most widely used civil procedures. It is limited to reclamations of an economic character. In virtue of Article 812 of the CPL, the recoverable debt must meet the following criteria: it must be in monetary form, it must be a liquid asset, it must be certain, the period for payment must have expired, and it must be recoverable in any proportion. Additionally, it is important to note that the procedure is subject to a 100 euro charge as well as a variable fee fixed at 0.5 % of the principal debt, as long as the quantity to be reclaimed is greater than 2,000.00€.

The monitorio procedure begins at the request of the creditor. This involves a simple written application, given that a creditor can now initiate the procedure by submitting any of the documents laid out in Article 812 of the CPL that confirms the relationship between the parties. The debtor then has the burden to oppose the allegation if he or she does not recognise the existence of the debt. This would bring forth a later procedure, at the end of which the judge decides in light of the proof put forward, which party is right.

The creditor must present the claim in the corresponding court of first instance, according to the pertinent territorial competence criteria. Once the initial request is submitted, the Judicial Secretary presides over its inspection and admission. If the Judicial Secretary finds that there are circumstances that call for rejection of the claim, the Judicial Secretary will inform the judge so that the judge can adopt the corresponding decision.

The debtor may adopt different positions in the process. One of them is to voluntarily pay the quantity requested by the claimant. He or she can also oppose the claim, expressing in writing the reasons why, in his or her opinion, he or she should not pay the debt in full or in part. Another possibility available to him or her is to let the deadline for action pass without paying or opposing the claim. In this case, and once the Judicial Secretary’s decision has been pronounced, the initiation of the process for seizing the debtor’s assets with which the debt can be paid must be requested in writing.

In conclusion, the monitorio process has huge importance in Spain’s legal system and can be considered as a fundamental instrument for the jurisdictional protection of credit.

Carlos Hernández Triana

For additional information regarding the recovery of debts in Spain,