Within the framework of redundancy procedures in Spain (Expediente de Regulación de Empleo or hereafter ERE), companies should take into account the economic contribution to the Public Treasury. That is because, when the collective dismissal affects people over 50 years of age, it can be very expensive for the company and thus decisive when it comes to deciding to proceed with it.

This measure is enshrined within the sixteenth additional provision of Law 27/2001 (A.P. 16), from the 1st August and the Royal Decree 1484/2012, from the 29th October, whose objective is both:

- On the one hand, to discourage the inclusion of older workers within redundancy proceedings due to their difficulty in reintegrating the labour market

- On the other hand, to avoid using age as the preferred criterion for selecting the workers subject to collective dismissal.

Calculation and form of presentation of the contribution

The system for calculating the economic contribution applies a percentage rate, defined in section 4) of D.A.16 Law 27/2011.

Companies complying with particular requirements must send the Labour Authority a certificate containing the data listed in art. 5 RD 1484/2012. These data refer fundamentally to the identification of the responsible company and to the fulfilment of the conditions required by the norm to activate the obligation to pay the economic contribution.

Deadlines for the submission of the certificate

The deadline for submitting the certificate will depend on whether or not the company obtained profits, and will be of:

- Three months from the end of the year following the start of the redundancy procedure, if the company obtained profits in the two previous financial years.

- Before the end of the financial year immediately following the financial year in which the requirement to obtain profits is met, in the event of a supervening profit (*).

Requirements for the contribution to be due

The cumulative requirements (i.e., if a condition is not met the contribution, will not proceed) for the contribution to proceed are as follows:

a) That the redundancy procedure is achieved by companies with more than 100 workers or companies that belong to a corporate group with that number of workers

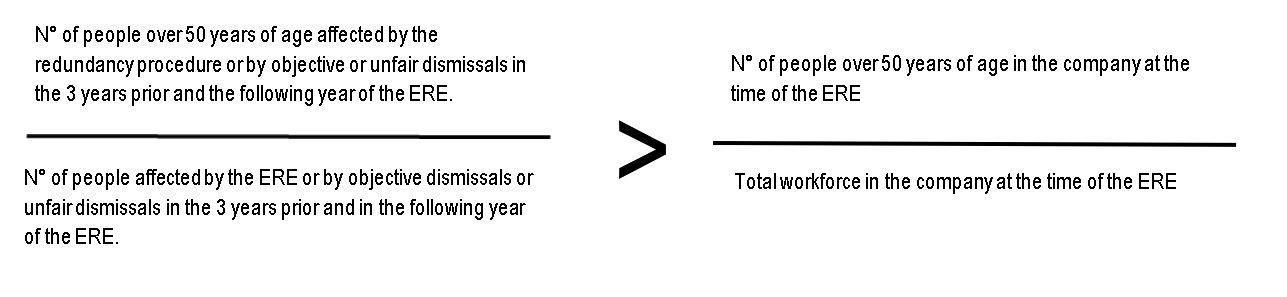

b) That the percentage of dismissed workers of 50 years of age or more over the total number of dismissed workers is higher than the percentage of workers of 50 years of age or more over the total number of workers within the company

To calculate the percentage of redundant workers aged 50 or more out of the total number of redundant workers, the following workers shall be included:

- Workers affected by the collective dismissal

- Workers whose contracts have been terminated by objective or disciplinary dismissals three years prior or in the year following the start of the redundancy procedure.

For the calculation of the percentage of workers aged 50 years of age or more over the total number of workers in the company, it will be taken into account the company’s workforce at the starting time of the redundancy procedure.

Thus, the calculation would be as follows:

c) That, even if the economic, technical, organizational or production causes justify the redundancy procedure, one of the following two conditions is met:

1. The company or corporate group to which it belongs has made profits in the two financial years before the one in which the collective redundancy procedure is initiated

2. The company or corporate group to which it belongs obtained profits in at least two consecutive fiscal years between the fiscal year before the beginning of the redundancy procedure and the four fiscal years following that date.

In conclusion, before initiating a redundancy procedure, the company should properly assess the economic consequences of said procedure.

Alejandra Sanz

(*) The obtention of profits is considered to be supervening when the benefits are obtained in at least two consecutive financial years.

For further information regarding redundancy procedures in Spain,