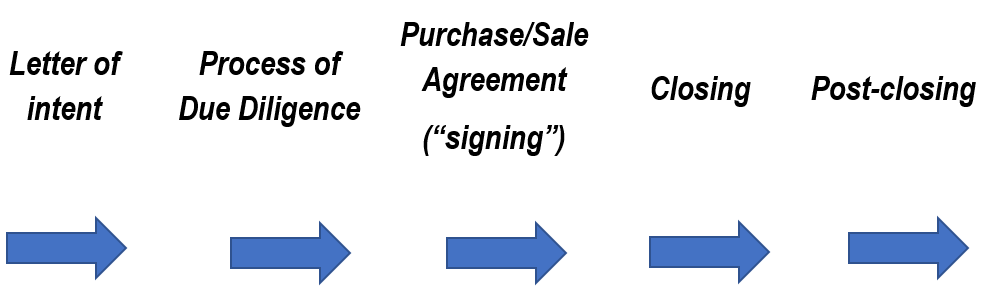

Acquiring a company in Spain, as an investment vehicle, by acquiring shareholdings can be carried out in two ways: through the full acquisition of all the shares and assets of the company, or through the acquisition of a small percentage of the same. It is necessary to bear in mind the different steps to be followed to conclude these types of transactions.

Phase 1 of acquiring a company: The letter of intent

As a first step in the acquisition of a company in Spain, it is common practice to sign a letter of intent. In this document -which can be unilateral or bilateral- the parties to the negotiation:

- Declare their commitment to start a negotiation, which will end with a definitive purchase agreement.

- Determine the preliminary pacts achieved to date.

- Define the points according to which a satisfactory agreement must be reached.

Phase 2 of acquiring a company: Due Diligence

Following the signing of the letter of intent, it is highly recommended that the purchaser carry out a Due Diligence process of the company they intend to acquire. This process involves investigating and analysing the company with the goal of understanding the risks or contingencies which may arise through its acquisition. This process is usually undertaken before contracting or carrying out any type of significant financial commitment or investment.

Phase 3 of acquiring a company: the signing of the purchase/sale agreement (closing)

Once the due diligence process has been completed in a satisfactory manner by the purchaser, the signing of the purchase/sale agreement will take place.

Phase 4 of acquiring a company: the signing of the purchase/sale agreement (closing)

In some cases, either due to the contingencies assessed during the aforementioned investigation process, or due to issues which are pending resolution by the parties (for example, the need to obtain some form of external authorization), the definitive closure of the transaction will be performed at a later time. In such cases, the purchase/sale agreement will be signed in accordance with the terms agreed to following the due diligence and the legal business will remain subject to compliance with the pending conditions (singing – closing deferred).

The type of strategy surrounding the closing of the operation will depend on the specific circumstances of the acquisition of the company and, largely, on the contingencies detected following the investigation process prior to the purchase/sale.

Phase 5 of acquiring a company: post-closing

Following the acquisition of a company, it is common for a series of corporate modifications to take place – dismissal and appointment of administrators, change of the registered office, change of the company name, etc. The notarization and inscription with the Public Registry of these modifications is known as post-closing or the closing operations of the transaction.

For further information regarding Acquiring a business in Spain,